INTERNATIONAL PAPER CO /NEW/ (IP)·Q4 2025 Earnings Summary

International Paper Q4 2025: Revenue Beat, Announces Breakup Into Two Companies

January 29, 2026 · by Fintool AI Agent

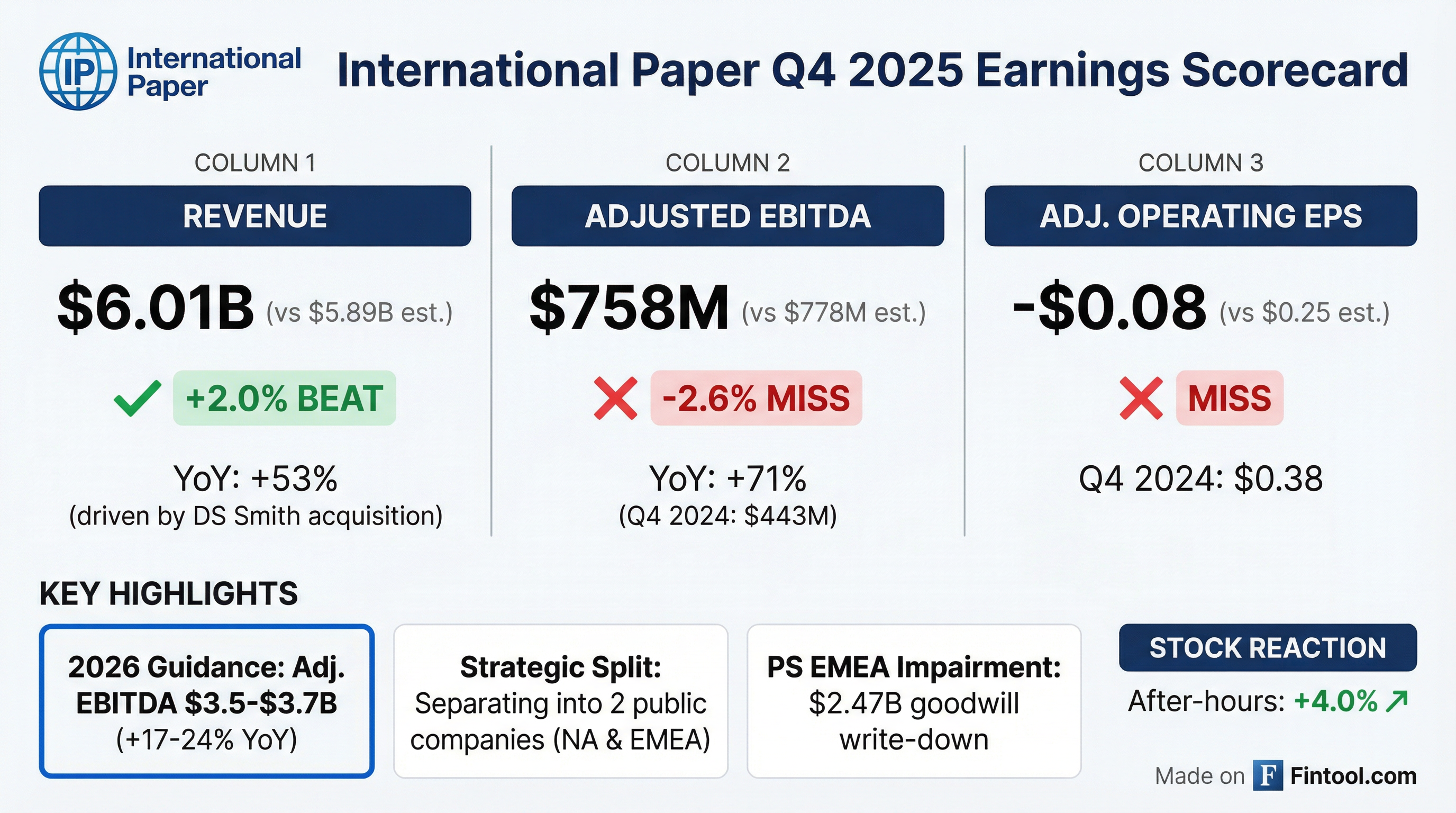

International Paper delivered mixed Q4 2025 results alongside a major strategic announcement: the company will split into two independent public companies, separating its North American and EMEA packaging operations. Revenue beat estimates by 2% at $6.01 billion, but adjusted EBITDA of $758 million missed consensus by 2.6% . The stock traded up 4% in after-hours as investors digested the breakup news and 2026 guidance of $3.5-$3.7 billion in adjusted EBITDA.

Did International Paper Beat Earnings?

Mixed quarter: Revenue beat but profitability metrics missed consensus.

The GAAP loss of $2.36 billion was driven by a massive $2.47 billion non-cash goodwill impairment charge on the EMEA segment, plus $90 million in accelerated depreciation and $160 million in restructuring charges .

What Did Management Guide?

CEO Andy Silvernail provided robust 2026 targets despite the challenging Q4:

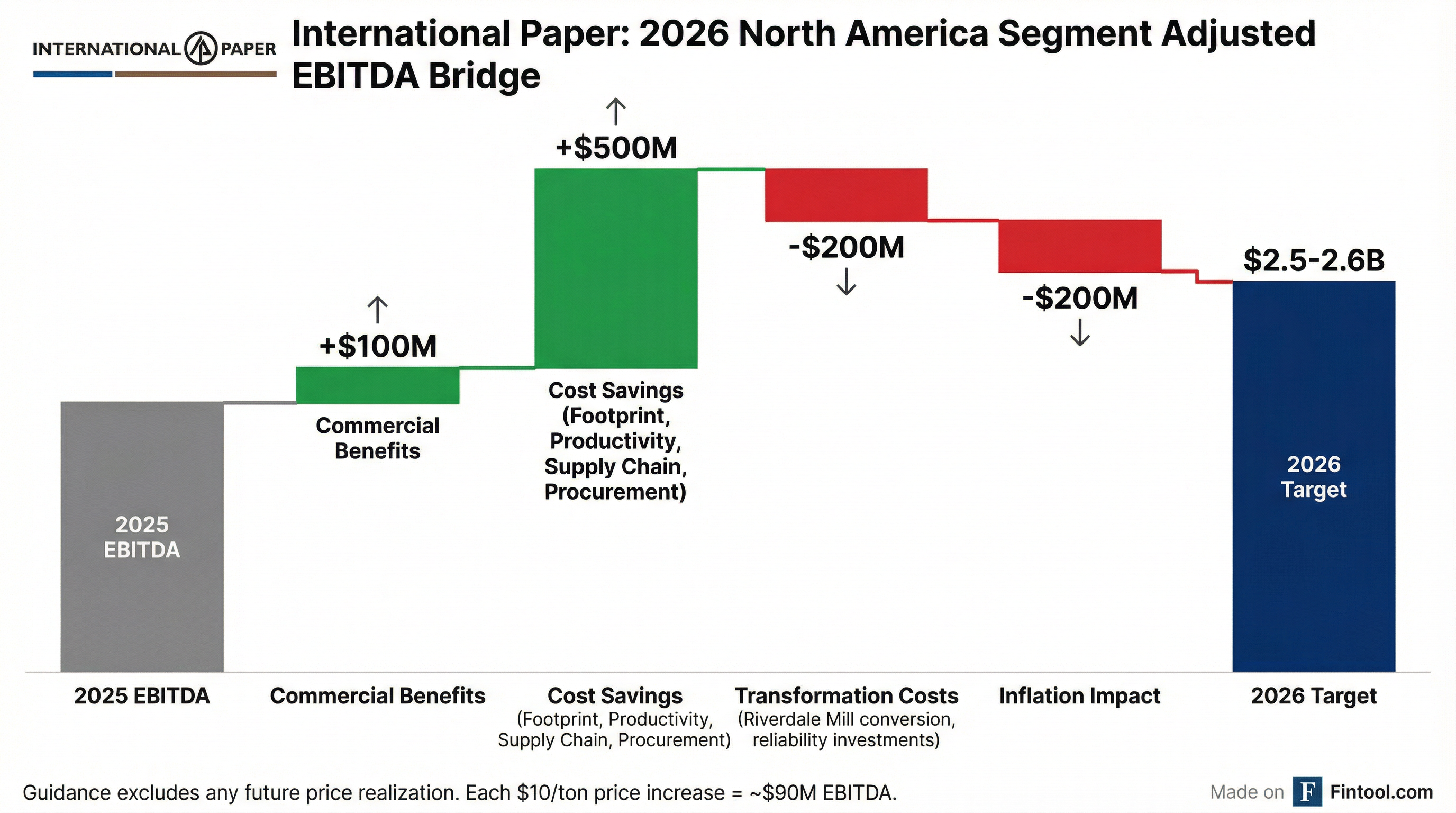

Price Increases Not in Guidance: Management confirmed they sent out price increase letters this week—$70/ton in North America and €100/ton in Europe. If fully realized, this would add ~$630M in NA and ~$300M in EMEA on an annualized basis . Each $10/ton that sticks in NA equals ~$90M of EBITDA .

Key caveats: Winter storm impact estimated at $20-25M for Q1 . Guidance assumes NA market flat to +1% with IP outperforming by ~2% .

How Will IP Deliver 2026 EBITDA?

Management provided exceptional detail on the building blocks for 2026 targets:

North America ($2.5-2.6B Target):

EMEA (~$1.0B Target):

H1 vs H2 Shape: The first half will see ~$165M of non-recurring timing impacts (maintenance outages, Riverdale costs) that unwind in H2. Normalized for these items, H1 shows ~10% YoY EBITDA growth. The second half ramp includes ~$200M from normalized outage schedule, ~$80M from Riverdale non-repeats, ~$75M from volume seasonality, and ~$200M from commercial/operational productivity .

What Changed From Last Quarter?

The Transformation Story Accelerates:

The biggest news was the announced split into two companies. After completing the DS Smith acquisition in January 2025 and integrating operations throughout the year, IP is now pursuing the opposite strategy—creating two focused regional champions .

North America rebounded dramatically — swinging from a $166 million loss in Q3 to $319 million profit in Q4. The improvement came from non-repeat of $619 million in accelerated depreciation from mill closures, higher box prices, strategic customer wins, and cost savings from the 80/20 initiative .

EMEA deteriorated further — losses widened from $58 million to $223 million on soft demand, lower prices, and higher depreciation from DS Smith acquisition accounting adjustments .

The Strategic Split: Why Now?

International Paper announced plans to separate into two independent public companies within 12-15 months :

Packaging Solutions North America — The core business generating 62% of revenue and strong profitability

- Q4 revenue: $3.72B with $319M operating profit

- FY 2025 revenue: $15.2B

- 37% YoY adjusted EBITDA improvement in H2 2025

Packaging Solutions EMEA — The DS Smith-led European operations struggling with demand

- Q4 revenue: $2.30B with $223M operating loss

- FY 2025 revenue: $8.5B

- $2.47B goodwill impairment taken in Q4

The goodwill impairment was triggered by the strategic review, where IP measured fair value versus carrying value of both segments. EMEA's carrying value exceeded fair value, necessitating the $2.47 billion write-down .

Leadership: Tim Nicholls (former IP CFO, current EVP leading EMEA) will serve as CEO of the standalone EMEA company. David Robbie (former DS Smith Senior Independent Director) expected to be appointed Chairman . Andy Silvernail, Tom Hamic, and Lance Loeffler will continue leading North American IP .

Investment: IP plans to invest ~$400M in EMEA throughout 2026 to fund the transformation and 80/20 implementation .

How Did the Stock React?

The initial reaction during regular trading was negative as investors digested the GAAP loss and EBITDA miss. However, the stock rallied 4% in after-hours trading as the market processed:

- The strategic split creating two focused pure-plays

- Strong 2026 guidance above current run-rate

- North America's sharp profitability rebound

- $255 million positive free cash flow in Q4

Capital Allocation Update

Deleveraging in focus ahead of the split:

The company completed the sale of its Global Cellulose Fibers (GCF) business on January 23, 2026 for $1.5 billion plus $190 million in preferred stock . This capital will help support the separation process.

80/20 Transformation Progress

North America:

- $510M run rate cost benefits achieved in 2025

- ~$110M from footprint optimization in 2025, similar expected in 2026

- Lighthouse model installed in 85% of box plant system

- On-time delivery improved to upper 90s%

- Voice of Customer surveys show highest satisfaction among direct competitors

EMEA:

- 20 site closures actioned, ~1,400 roles impacted

- Additional 7 sites and 700+ roles in works council discussions

- Expected run rate savings: >$160M

- Leading NPS scores vs top European players

Key Risks and Concerns

- EMEA headwinds persist — Soft demand environment and pricing pressure continue; losses widened QoQ

- Separation execution — 12-15 month timeline introduces complexity; costs and distractions during transition

- Leverage elevated — $9.8B total debt post-DS Smith; need to manage capital structure through split

- Winter storm impact — Estimated $20-25M Q1 impact

- Tariff uncertainty — Forward-looking statement cites trade policy risks including potential retaliatory measures

Q&A Highlights

On Dividend Coverage: The $300-500M free cash flow guidance doesn't cover the ~$1B annual dividend. Silvernail acknowledged this is due to substantial 2026 restructuring and one-time costs: "We are maintaining our dividend policy as it is through 2026... through any process like this, you're gonna review that, work in conjunction with shareholders." The breakeven point is $3.6-3.7B EBITDA .

On H2 Execution Confidence: Asked about past shortfalls on ops/costs in Q2-Q4 2025, Silvernail noted: "The vast majority of what we're talking about are things that have been actioned, and the tail here are the cost of finalizing that... closures and the lingering cost of finalizing those closures. Those tails start to fall off" .

On Volume Quality: Market share wins in H2 2025 (3-4 points above market) came at appropriate pricing: "If you look at the volume wins we've had in North America, they have been absolutely at those quality levels... you can see the expanding margins at the same time" .

On Why Separate Now: "The real driver for this decision is the fact that the value is really in the regions... they're really distinctive markets. Using 80/20 as the lens, you wanna simplify, take the complexity out, focus on where the value is" .

On January Start: "The year has started strong... January was strong. We've seen that in our daily numbers" .

Forward Catalysts

Full-Year 2025 Summary

The revenue jump reflects the DS Smith acquisition (completed January 31, 2025), which added approximately $8B in annual EMEA revenue. EBITDA nearly doubled but free cash flow turned negative due to elevated capital spending for integration and mill restructuring.

Data sourced from International Paper 8-K filed January 29, 2026. Consensus estimates from S&P Global.

View IP Company Page | View Q3 2025 Earnings | View Transcript